Influential business investors answer your questions

- Published

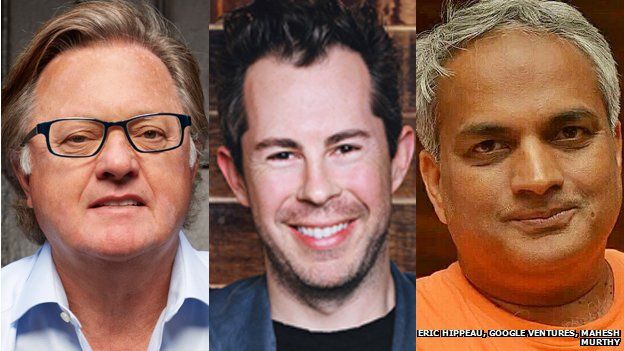

Eric Hippeau of Lerer Hippeau Ventures , Bill Maris of Google Ventures and Mahesh Murthy of Seedfund answer your questions

Last week we asked three influential business investors what they look for when deciding whether to put money into a venture and what they run away from.

Bill Maris from Google Ventures, which has just opened its London office; Eric Hippeau from Lerer Hippeau Ventures in New York; and Mahesh Murthy from Seedfund in Mumbai all gave us their views and you can read them here - How to ask for $250m.

Our three investors also agreed to answer questions from our readers - so thank you very much to everyone who sent in questions via email and Twitter.

How much weight do you give to a business plan? Do you really read past the executive summary? What is the critical factor that makes you decide to invest or not? John Robinson, UK

Mahesh Murthy, managing partner, Seedfund:

"Nobody I've seen so far has ever executed to a business plan, so I don't pay much heed to the document, but more to the elevator pitch or the executive summary, and simply get to understand what is it the entrepreneur wishes to do, is it up our alley, and can he or she pull it off?"

Bill Maris, founder and managing partner, Google Ventures:

"I'm really focused on the team more than the plan - who are the founders? What are their backgrounds, their interests and motivations? What do they want to accomplish, and how big is their vision? How do they deal with failure and how do they take input and criticism? Who are they going to hire, and how are they going to get them? Have they talked to them yet?

"I'm not really interested in a 50-page business plan with detailed financial projections - they are almost always wrong and not very useful. Ten slides, max, is usually all you need - and a demo of your idea or product if you have one.

"I'd rather you work more on your business than your business plan. Ideas are easy and inexpensive, even free, execution is difficult, and that's about the founders and the first 10 hires. That's what I want to know about -especially for early stage ventures."

Eric Hippeau, managing director Lerer Hippeau Ventures:

"We look at business plans closely to understand the thought processes driving the management team. Business plans are one of a number of factors which will make us decide to invest or not."

When we asked all three investors how to approach them they all said that people who were personally recommended to them jumped the queue - something that our next question follows up on.

So little effort is made to reach out to driven young entrepreneurs unless they're at the highest-ranking universities, despite some of the worlds finest business minds being drop-outs at college. It seems, with the process of simply waiting to be introduced to entrepreneurs, that only a relatively small net is cast out within a specific pool of people for business ideas. Alistair Brown, UK

Bill Maris, Google Ventures:

"For me, this process isn't about casting a huge net and trawling for entrepreneurs like tuna. It's about finding the brightest, most motivated, hardest-working entrepreneurs and those folks will usually find a way to talk to the investors they are looking for.

"That's about being very selective and thoughtful, not about casting a huge net. That's one reason we don't solicit business plans on our Web site.

"If you are relying on investors to come to you, you are in the wrong business. Investors don't do the hard work of starting and running companies, the founders do - and part of that job is ensuring that you find investors that are a good match in experience, enthusiasm, vision, temperament and more.

"We are looking to build lasting, long-term relationships with entrepreneurs through perhaps multiple companies. It's not about where you went to school, or even if you did at all...it's about what you're doing and going to do as much as it is about what you have done."

Mahesh Murthy, Seedfund:

"Most of the people who get into Indian institutes of technology and Indian institutes of management are safety-seekers who tend to graduate and get into staid, boring jobs like ones at McKinsey, Goldman and such. They're not quite entrepreneur material.

"I'm a college drop-out myself and don't particularly put any significant value on any educational qualification of any sort for an entrepreneur. I don't think the better venture capital funds in India do either.

"To connect with funds so you can pitch, write to us at info@seedfund.in and alternatively, connect with us or others like us in person via a networking organisation like TiE (The Indus Entrepreneurs), or get on LinkedIn, and find someone who knows a venture capital [fund] you'd like to connect with and get them to put in a good word for you."

Eric Hippeau, Lerer Hippeau Ventures:

"Someone looking for funding is going to have to do a fair amount of due diligence on the funds they are trying to pitch. That process should lead to discovering mutual acquaintances capable of making an initial introduction."

Can support for developing countries governments be better targeted as private sector loans with lower interest rates? Wisdom Amegbletor via Twitter

Mahesh Murthy, Seedfund:

"Any kind of loans or credit can be a good idea for a lot of entrepreneurs - because equity is not a good solution in many cases.

"The key issue in most developing countries is that banks are directed to take collateral against hard assets to give loans - and entrepreneurs typically don't tend to have too many spare assets lying around.

"Governments can make a big difference by reinsuring the loans given by banks to a particular value - or by putting up schemes that make easy credit easily available - and also by directing a part of government spending to be sourced from younger and smaller companies."

Are you interested in Social Equity projects? Igol Allen via Twitter

Eric Hippeau, Lerer Hippeau Ventures:

"If Social Equity means non-profit, than the answer is no."

Mahesh Murthy, Seedfund:

"Yes, but they also have to be clearly commercialisable and have exit potential. We're not a social venture fund but a regular venture fund with a bit of a conscience."