The pick of this week's business news: From bankers to cats

- Published

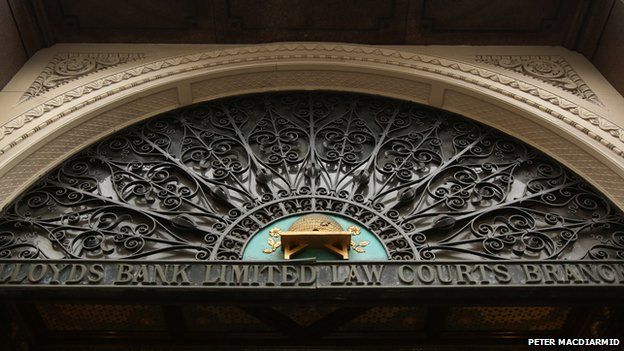

Bankers. So important, the government was prepared to spend £2,000 for every person keeping them afloat.

We learned that Lloyds Banking Group repaid this with yet another fiddle.

It used the Special Liquidity Scheme (SLS), set up in 2008 by the Bank of England, to let banks temporarily swap assets that were difficult to trade.

Bankers at Lloyds manipulated a rate - called the repo rate - in order to make using this scheme cheaper. That lowered the price the bank paid to use it, cutting returns (ultimately) to the taxpayer.

Essentially, that's like stealing from the fire brigade when they come to save your home.

Bank of England governor Mark Carney was forthright. In some of the strongest language seen from any England bank governor, he called it "highly reprehensible" behaviour. Criminals would go to jail, he said.

The list of misdemeanours seems ever growing: There are at least 10 authorities investigating 20 banks worldwide: dark pools, currency rigging, interest rate fixing, fixing the gold fix... and who knows? The price of cat food?

Could the answer lie here? Bankers should "swear ethics oath", suggested think tank ResPublica. "In medicine, the Hippocratic Oath provides a centrepiece for personal responsibility in the profession. We believe that the Bankers' Oath could perform a similar function."

An idea that was rebuffed: "It doesn't stop rogue doctors." In any case, as bankers as a group have not proved themselves very trustworthy to say the least, would we believe any promises they made?

Financial crimes were punishable by death in England from the late Middle Ages until Victorian times - and even that didn't stop people trying to fiddle finances.

Banker bonuses also featured - with an extension to the time-frame in which they are paid - and most importantly, in which they can be clawed back, should their performance turn out to be a mirage. Worries about this included the fact they could easily hide the proceeds - after all, finance is their game.

A crazy number of major company results - and almost as many ways of presenting them. Whatever happened to the pre-tax profit figure that used to be prominent in every set? Amid the list of leading companies with results pouring out on Thursday, there weren't two the same among them.

These things are prepared by committee - with the in house PR, the external PR and the investor relations people among those fighting to present in the best way for their constituents. The chief executive or chairman would be lucky to get a look in, despite the fact their names go on them.

Well, three cheers for Centrica, then. "Customer relationships are core to the long term health of Centrica," as Sam Laidlaw, outgoing chief executive said in May - after years of being biffed about the head by disgruntled customers and regulators. Very nicely written were its results. Proper pre-tax profits and brass-tacks business information, including telling customers bills will go down and profit margins will fall to 4%.

From the mundane to the special: "VIP Club Treatment: Teeth cleaning, SPA™ Blueberry facial, Luxury Shampoo, Hydrating butter treatment" and a load more, finishing with "Paw wax treatment".

This is one of the services offered by the newly listed Pets at Home chain.

It also sells this: "Groom Room OMG! Odour Buster Deodorising Spritzer with Byotrol." Glad it has Byotrol in it. Could this help sanitise the banking system?

The spa treatment costs a tenner, by the way. With their bonuses being cut, that may be all the bankers can afford by way of a treat.

Just don't let them near the cat food.