US stocks pare losses triggered by Michael Flynn reports

- Published

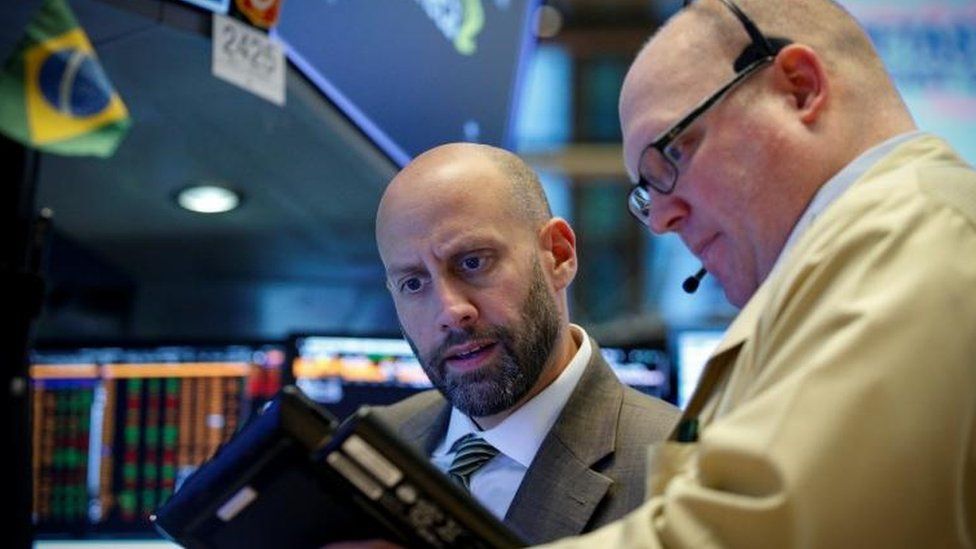

Stocks on Wall Street closed lower on Friday, but pared the steepest losses triggered by reports related to an ongoing investigation of Russian influence in the Trump campaign.

Increased confidence that Congress is on track to pass a corporate tax cut helped to stem the declines.

The Dow Jones closed at 24,231.59, down 40.76 points or 0.17%.

The S&P 500 fell 5.4 points or 0.2% to 2,642.1, and the Nasdaq fell 26.39 points to 6,847.59.

The indexes plunged mid-morning, after President Donald Trump's former national security adviser Michael Flynn pleaded guilty to lying to the FBI.

The fall came after a stock rally earlier in the week, as investors anticipated rewards from the corporate tax cut included in a Republican tax proposal.

The indexes started to drift higher again Friday afternoon, as Senate Republicans said they had the votes to pass the bill, despite details that remained in flux.

Shares in Goldman Sachs closed up 0.5%, while shares in JP Morgan Chase rose 0.26%. Both firms are among those expected to benefit from the corporate tax cut.

American Airlines and Alaska Air were among the firms that were lower, with shares in both firms falling about 3%.

US markets have surged this year, prompting concerns about over-valuations.

The Nasdaq has increased about 26% since January, while the S&P 500 is up almost 22% and the Dow is up about 17%.